Neural Network

A neural network is a series of algorithms that endeavours to recognize underlying relationships in a set of data through a process that mimics the way the human brain operates. In this sense, neural networks refer to systems of neurons, either organic or artificial in nature as shown in figure 1. Neural networks can adapt to changing input; so the network generates the best possible result without needing to redesign the output criteria. [1] The concept of neural networks, which has its roots in artificial intelligence, is swiftly gaining popularity in the development of trading systems.

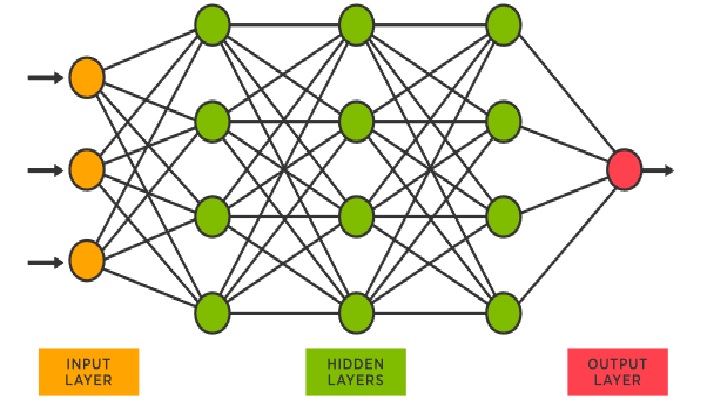

Figure 1. Artificial Neural Networks

Basics of Neural Networks

Neural networks, in the world of finance, assist in the development of such process as time-series forecasting, algorithmic trading, securities classification, credit risk modelling and constructing proprietary indicators and price derivatives.

A neural network works similarly to the human brain’s neural network. [2] A “neuron” in a neural network is a mathematical function that collects and classifies information according to a specific architecture. The network bears a strong resemblance to statistical methods such as curve fitting and regression analysis.

A neural network contains layers of interconnected nodes. Each node is a perceptron and is similar to a multiple linear regression. The perceptron feeds the signal produced by a multiple linear regression into an activation function that may be nonlinear.

Application of Neural Networks

Neural networks are broadly used, with applications for financial operations, enterprise planning, trading, business analytics and product maintenance. [3] Neural networks have also gained widespread adoption in business applications such as forecasting and marketing research solutions, fraud detection and risk assessment.

A neural network evaluates price data and unearths opportunities for making trade decisions based on the data analysis. The networks can distinguish subtle nonlinear interdependencies and patterns other methods of technical analysis cannot. According to research, the accuracy of neural networks in making price predictions for stocks differs. Some models predict the correct stock prices 50 to 60 percent of the time while others are accurate in 70 percent of all instances. Some have posited that a 10 percent improvement in efficiency is all an investor can ask for from a neural network.1

There will always be data sets and task classes that a better analyzed by using previously developed algorithms. It is not so much the algorithm that matters; it is the well-prepared input data on the targeted indicator that ultimately determines the level of success of a neural network.

Types of neural networks

Neural networks can be classified into different types, which are used for different purposes. While this isn’t a comprehensive list of types, the below would be representative of the most common types of neural networks that you’ll come across for its common use cases:

Feedforward neural networks, or multi-layer perceptron’s (MLPs), are what we’ve primarily been focusing on within this article. They are comprised of an input layer, a hidden layer or layers, and an output layer. [4] While these neural networks are also commonly referred to as MLPs, it’s important to note that they are actually comprised of sigmoid neurons, not perceptron’s, as most real-world problems are nonlinear. Data usually is fed into these models to train them, and they are the foundation for computer vision, natural language processing, and other neural networks.

Convolutional neural networks (CNNs) are similar to feedforward networks, but they’re usually utilized for image recognition, pattern recognition, and/or computer vision. These networks harness principles from linear algebra, particularly matrix multiplication, to identify patterns within an image.

Recurrent neural networks (RNNs) are identified by their feedback loops. These learning algorithms are primarily leveraged when using time-series data to make predictions about future outcomes, such as stock market predictions or sales forecasting.

Advantages of neural Networks:

ANNs have some key advantages that make them most suitable for certain problems and situations [5]:

- ANNs have the ability to learn and model non-linear and complex relationships, which is really important because in real-life, many of the relationships between inputs and outputs are non-linear as well as complex.

- ANNs can generalize — After learning from the initial inputs and their relationships, it can infer unseen relationships on unseen data as well, thus making the model generalize and predict on unseen data.

- Unlike many other prediction techniques, ANN does not impose any restrictions on the input variables (like how they should be distributed). Additionally, many studies have shown that ANNs can better model heteroskedasticity i.e. data with high volatility and non-constant variance, given its ability to learn hidden relationships in the data without imposing any fixed relationships in the data. This is something very useful in financial time series forecasting (e.g. stock prices) where data volatility is very high.

References:

- https://www.investopedia.com/terms/n/neuralnetwork.asp

- https://www.ibm.com/in-en/cloud/learn/neural-networks

- https://wiki.pathmind.com/neural-network

- https://searchenterpriseai.techtarget.com/definition/neural-network

- https://towardsdatascience.com/introduction-to-neural-networks-advantages-and-applications-96851bd1a207

Cite this article:

D. Vinotha (2021), Neural Network, AnaTechMaz, pp. 4