How it works: Blockchain

If electronic money is just data, nothing physically stops a currency holder trying to spend it twice. Enter the Bitcoin blockchain.

Blockchain is an algorithm and distributed data structure designed to manage electronic cash without any central administrator. The original blockchain was invented in 2008 by the pseudonymous Satoshi Nakamoto to support Bitcoin, the first large-scale peer-to-peer crypto-currency, completely free of government and institutions [1].

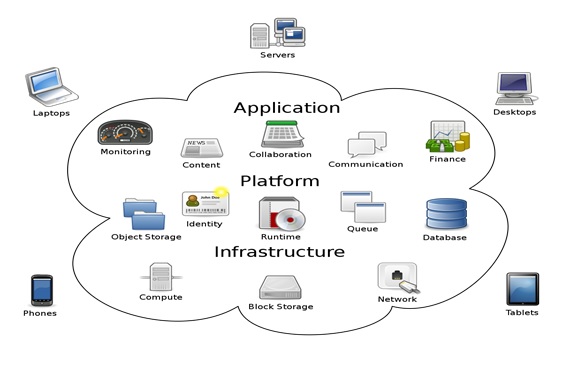

Blockchain is a Distributed Ledger Technology (DLT). Most DLTs have emerged in Bitcoin's wake. Some seek to improve blockchain's efficiency, speed or throughput; others address different use cases, such as more complex financial services, identity management, and "Smart Contracts".

The central problem in electronic cash is Double Spend. If electronic money is just data, nothing physically stops a currency holder trying to spend it twice [2]. It was long thought that a digital reserve was needed to oversee and catch double-spends, but Nakamoto rejected all financial regulation, and designed an electronic cash without any umpire.

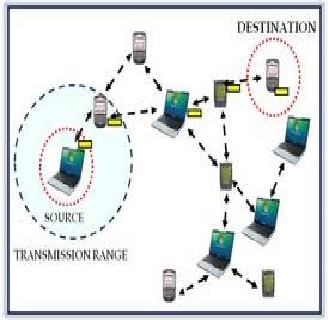

The Bitcoin (BTC) blockchain crowd-sources the oversight. Each and every attempted spend is broadcast to a community, which in effect votes on the order in which transactions occur. Once a majority agrees that all transactions seen in the recent past are unique, they are cryptographically sealed into a block [3]. A chain thereby grows, each new block linked to the previously accepted history, preserving every spend ever made.

A Bitcoin balance is managed with an electronic wallet, which protects the account holder's private key. Blockchain uses conventional public key cryptography to digitally sign each transaction with the sender's private key and direct it to a recipient's public key [4]. The only way to move Bitcoin is via the private key: lose or destroy your wallet, and your balance will remain frozen in the ledger, never to be spent again.

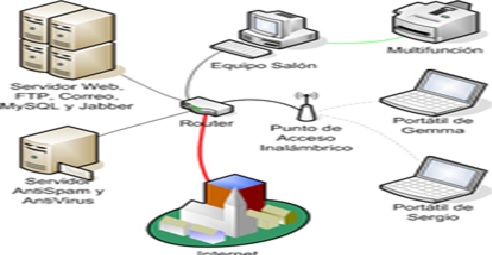

The blockchain's network of thousands of nodes is needed to reach consensus on the order of ledger entries, free of bias, and resistant to attack. The order of entries is the only thing agreed upon by the blockchain protocol, for that is enough to rule out double spends.

The integrity of the blockchain requires a great many participants (and consequentially the notorious power consumption). One of the cleverest parts of the BTC blockchain is its incentive for participating in the expensive consensus-building process [5]. Every time a new block is accepted, the system randomly rewards one participant with a bounty (currently 12.5 BTC). This is how new Bitcoins are minted or "mined".

Blockchain has security qualities geared towards incorruptible cryptocurrency. The ledger is immutable so long as a majority of nodes remain independent, for a fraudster would require infeasible computing power to forge a block and recalculate the chain to be consistent [6]. With so many nodes calculating each new block, redundant copies of the settled chain are always globally available.

Contrary to popular belief, blockchain is not a general-purpose database or "trust machine". It only reaches consensus about one specific technicality - the order of entries in the ledger - and it requires a massive distributed network to do so only because its designer-operators choose to reject central administration. For regular business systems, blockchain's consensus is of questionable benefit.

References:

- “Introducing blockchain,” Blockchain and the Digital Economy, pp. 1–14, Jul. 2020.

- G. Parry and J. Collomosse, “Perspectives on ‘Good’ in Blockchain for Good,” Frontiers in Blockchain, vol. 3, Jan. 2021.

- https://builtin.com/blockchain

- “Collusion on blockchain,” Blockchain + Antitrust, pp. 137–160, 2021.

- https://www.oracle.com/in/blockchain/

- https://www.euromoney.com/learning/blockchain-explained/what-is-blockchain

Cite this article:

C. V. Harry (2021), How it works: Blockchain, AnaTechMaz, pp. 2