Artificial Intelligence in Finance

AI and the finance industry are a match made in heaven. The financial sector relies on accuracy, real-time reporting and processing high volumes of quantitative data to make decisions, all areas intelligent machines excel in. As the industry takes note of AI's efficiency and accuracy, it is rapidly implementing automation, chatbots, adaptive intelligence, algorithmic trading and machine learning into financial processes. One of the biggest financial trends of 2018 is the robo-advisor, an automated portfolio manager. These automated advisors use AI and algorithms to scan data in the markets and predict the best stock or portfolio based on preferences. Wealth management firms are turning towards robo-advisors, not only because it saves both the company and client time and money, but it also produces some extraordinary returns.[1]

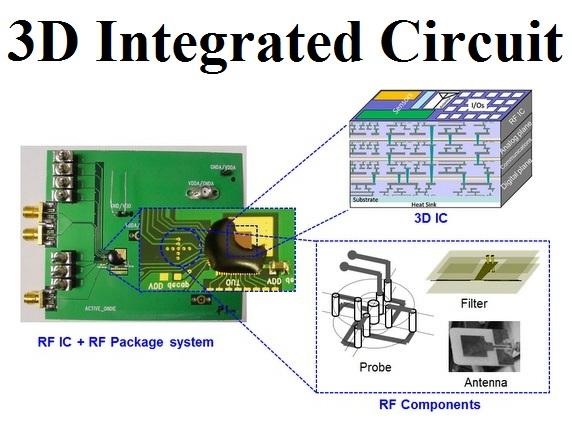

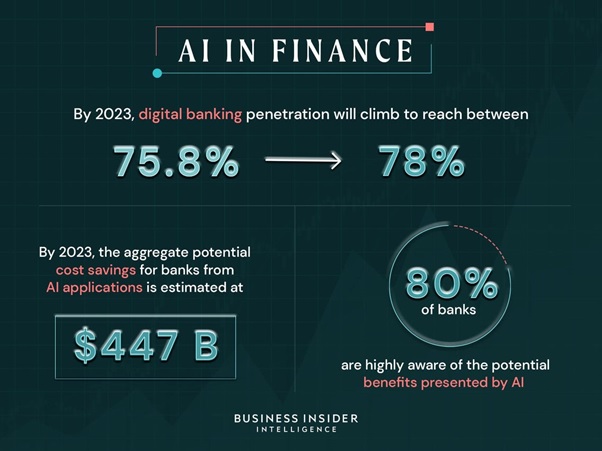

Figure 1. AI in Finance

Figure 1 shows artificial intelligence has streamlined programs and procedures, automated routine tasks, improved the customer service experience and helped businesses with their bottom line. In fact, Business Insider predicts that artificial intelligence applications will save banks and financial institutions $447 billion by 2023.The majority of banks (80%) understand the potential benefits of AI, but now it’s more important than ever with the widespread impact of COVID-19, which has affected the finance industry and pushed more people to embrace the digital experience.

In a recent AI News article, Mani Naga sundaram, senior vice president and head of solutions of global financial services at HCL Technologies, explained that COVID-19 has forced banks and financial institutions to respond to customers at an even faster pace — and around the clock. Artificial intelligence can free up personnel, improve security measures and ensure that the business is moving in the right technology-advanced, innovative direction.

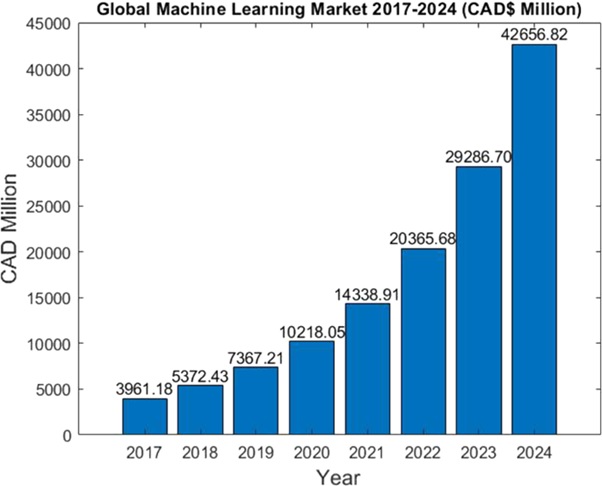

According to Forbes, 70% of financial firms are using machine learning to predict cash flow events, adjust credit scores and detect fraud.[2]

How it's using AI:

Betterment is an automated financial investing platform and a pioneer of robo-advisor technology that uses AI to learn about an investor and build a personalized profile based on his or her financial plans.

Betterment's robo-advisors use algorithms to automate tax loss harvesting, trading, transactions and portfolio management, all tasks that used to require a lot of human elbow grease and know-how. Betterment has $10 billion worth of assets under management and as of last year was serving 250,000 customers.[1]

The Future of AI in Finance

Since artificial intelligence has become more widespread across all industries, it’s no surprise that it is taking off within the world of finance, especially since COVID-19 has changed human interaction. By streamlining and consolidating tasks and analyzing data and information far faster than humans, AI has had a profound impact, and experts predict that it will save the banking industry about $1 trillion by 2030.

“Artificial intelligence technologies are increasingly integral to the world we live in, and banks need to deploy these technologies at scale to remain relevant,” according to McKinsey & Company. “Success requires a holistic transformation spanning multiple layers of the organization.”

It’s also important to note that millennials and “Gen Zers” are becoming the banks’ “largest addressable consumer group” in the United States, which means financial institutions are looking to increase their IT and AI budgets “to meet higher digital standards” since younger consumers often prefer digital banking. In fact, 78% of millennials say they won’t go to a bank if there’s an alternative.[2]

References:

- https://builtin.com/artificial-intelligence/examples-ai-in-industry

- https://onlinedegrees.sandiego.edu/artificial-intelligence-finance/

Cite this article:

Thanusri swetha J (2021), Artificial intelligence in Finance, Anatechmaz, pp. 27