Fraud Detection

Data mining to classify, cluster, and segment the data and automatically find associations and rules in the data that may signify interesting patterns, including those related to fraud. [1]

Fraud detection is a set of proactive measures undertaken to identify and prevent fraudulent activities and financial losses. Its main analytical techniques can be divided into two groups:

- Statistical: statistical parameter calculation, regression, probability distributions, data matching

- Artificial intelligence (AI): data mining, machine learning, deep learning [2]

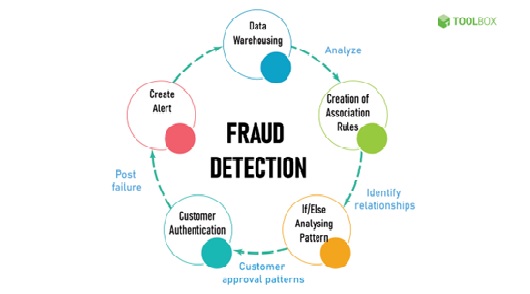

Figure 1. Fraud detection

Fraud detection is shown in figure 1. Fraud can take many different forms and affect all sectors, although the extent of the damage varies from one industry to another. There are various measures and tactics that are used by the industries that commonly deal with fraud detection to stop it. The most crucial thing industries must accomplish is finding out the root cause of the fraud.

Some of the major industries and areas where Data Science can be used to detect fraud include Taxation, the Banking industry, the Pharmaceutical industry, Cyber fraud and the Finance industry.

- Data Science for Fraud Detection in Taxation

- Data Science for Fraud Detection in the Pharmaceuticals Industry

- Data Science for Fraud Detection in Banking Industry

- Data Science for Fraud Detection in Cyber Space

- Data Science for Detecting Fraud in Financial Industries [3]

Benefit from Fraud Detection

Businesses that are most at risk for financial fraud should have at least some fraud detection measures in place. These can include banks, credit card companies, insurance firms, and businesses that conduct significant online transactions. While any business carries some risk of being defrauded, companies with large transaction amounts, high numbers of transactions, or contactless business models are at a greater risk for fraud.

Advanced Fraud Detection Features

As fraud detection technology has advanced, so have the features available to business owners. Many fraud detection systems now offer several filters that can quickly flag abnormal transactions. Business owners can set filters to flag transactions from specific regions or countries, or that are above certain threshold amounts. Utilizing these filters gives the business owner some direct control to verify and approve transactions before the money exchanges hands. [4]

References:

- https://en.wikipedia.org/wiki/Data_analysis_for_fraud_detection

- https://www.datacamp.com/blog/data-science-in-banking

- https://collegedunia.com/social/368-the-application-of-data-science-in-fraud-detection-and-prevention

- https://www.mitel.com/features-benefits/fraud-detection

Cite this article:

Gokula Nandhini K (2023), Fraud Detection, AnaTechMaz, pp.77