Hong Kong Advances Virtual Asset Initiative with Expanded Licensing and Trading Options

Hong Kong is broadening investment opportunities in virtual assets, its financial regulator announced on Wednesday (Feb 19), as the city strives to become Asia’s leading digital assets hub and attract capital.

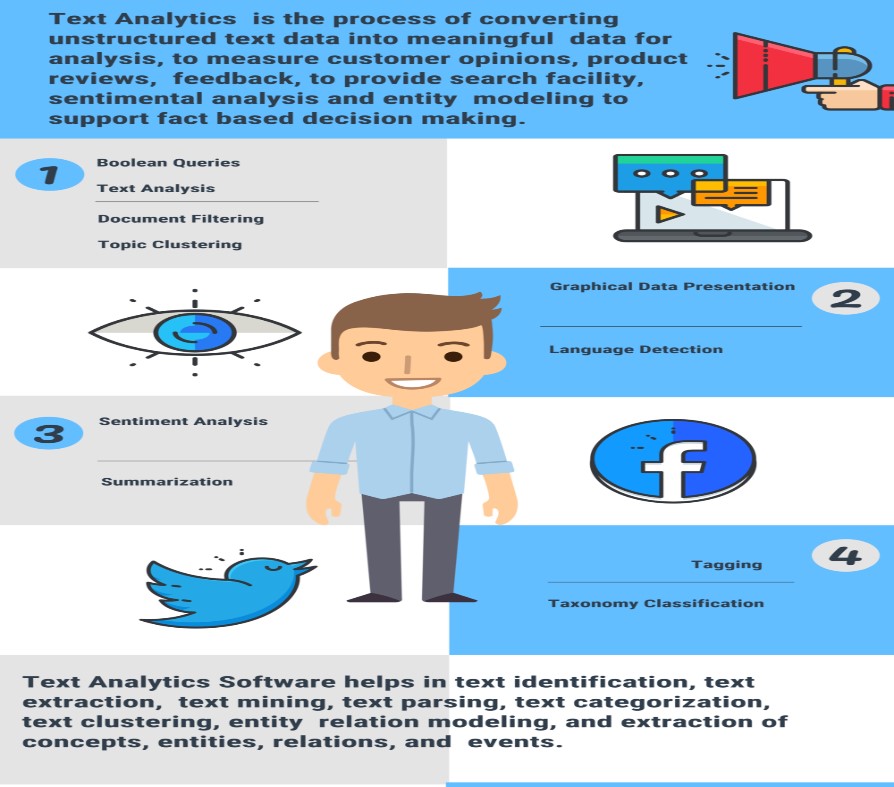

Figure 1. Hong Kong Expands Virtual Asset Market with New Licensing & Trading Opportunities.

The Securities and Futures Commission announced on Wednesday that it will introduce new licensing frameworks for over-the-counter virtual asset trading and custody services, aiming to enhance market efficiency and strengthen investor protections. Figure 1 shows Hong Kong Expands Virtual Asset Market with New Licensing & Trading Opportunities.

The regulator stated that derivative trading and margin financing options for virtual assets are also under review, following the announcement by its CEO, Julia Leung, at CoinDesk’s Consensus Hong Kong 2025 conference earlier.

Hong Kong first outlined its plan to become a virtual asset trading hub in 2022, following Beijing’s comprehensive ban on cryptocurrency transactions in mainland China the previous year.

Since then, the city has introduced Asia’s first spot crypto exchange-traded funds and granted nine virtual asset trading platform (VATP) licenses, Financial Secretary Paul Chan stated at the conference.

Additionally, regulators are progressing in the oversight of stablecoins and have introduced legislation to support further innovation, he added.

These initiatives “reflect our commitment to building a thriving digital asset ecosystem,” Chan said.

Bullish Group, the owner of crypto news website CoinDesk, announced on Tuesday that it had become the 10th licensed crypto exchange in Hong Kong.

Consensus Hong Kong marks the first major crypto industry gathering since U.S. President Donald Trump took office last month, with speakers expressing optimism about the regulatory landscape.

“There’s a big shift in sentiment in the US,” said Richard Teng, CEO of Binance Holdings.

He noted that sovereign wealth funds and institutional investors have moved beyond debating whether to invest in crypto and are now considering how much to allocate.

Bitcoin more than doubled in value last year, reaching an all-time high of $109,071 on Jan 20, the day of Trump’s inauguration. However, it has since retreated to around $96,000.

Hong Kong’s crypto expansion is seen by some as a potential indicator of Beijing’s evolving stance on virtual asset regulations, especially as the new crypto-friendly U.S. administration develops policies and explores a national reserve to support the industry.

“Hong Kong’s role for China, not just in crypto but overall, is unique—it’s one country, two systems,” said Lawrence Chu, co-founder and CEO of digital asset firm IDA.

“We serve as a sandbox, possibly for China, but also as a conduit for various activities.”

Hong Kong’s Ambition to Become Asia’s Digital Asset Hub

- Hong Kong’s push to lead the virtual asset market in Asia.

- Government and regulatory strategies to attract global investors.

- Competitive landscape: how Hong Kong compares to Singapore and other financial hubs.

New Licensing Regimes for Virtual Asset Trading

- Introduction of new licensing for over-the-counter (OTC) trading and custody services.

- How these measures enhance market transparency and security.

- Implications for crypto exchanges, brokers, and financial institutions.

Expanding Trading Options for Investors

- Overview of potential derivatives trading and margin financing for virtual assets.

- How these options can increase liquidity and investment flexibility.

- Balancing innovation with risk management to protect investors.

Regulatory Landscape and Investor Protections

- The Securities and Futures Commission’s (SFC) role in ensuring a fair market.

- Compliance requirements for virtual asset service providers.

- How investor protection measures align with global best practices.

The Future of Hong Kong’s Crypto Ecosystem

- Expected impact on Hong Kong’s economy and financial sector.

- Potential growth in blockchain innovation and fintech startups.

- Long-term vision: Will Hong Kong become the leading digital asset hub in Asia?

Reference:

- https://www.businesstimes.com.sg/companies-markets/banking-finance/hong-kong-expands-virtual-asset-push-new-licensing-trading-options

- https://www.reuters.com/technology/hong-kong-issues-nine-digital-asset-platform-licenses-plans-more-approvals-2025-02-19/

Cite this article:

Priyadharshini S (2025),"Hong Kong Advances Virtual Asset Initiative with Expanded Licensing and Trading Options",AnaTechMaz, pp. 71