Quantum Computing for Finance

Quantum computation can be applied to financial problems, providing an overview of current approaches and potential prospects. We review quantum optimization algorithms, and expose how quantum annealers can be used to optimize portfolios, find arbitrage opportunities, and perform credit scoring. We also discuss deep-learning in finance, and suggestions to improve these methods through quantum machine learning. Finally, we consider quantum amplitude estimation, and how it can result in a quantum speed-up for Monte Carlo sampling. This has direct applications to many current financial methods, including pricing of derivatives and risk analysis.[1]

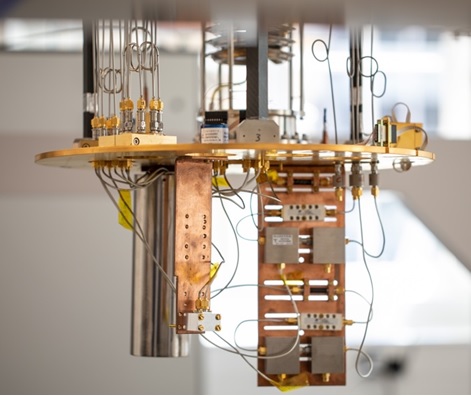

Figure 1. Quantum computing for finance

Figure 1 shows many financial services activities, from securities pricing to portfolio optimization, require the ability to assess a range of potential outcomes. To do this, banks use algorithms and models that calculate statistical probabilities. These are fairly effective but are not infallible, as was shown during the financial crisis a decade ago, when apparently low-probability events occurred more frequently than expected.[2]

Applying emerging quantum technology to financial problems

Financial services has a history of successfully applying physics to help solve its thorniest problems. The Black-Scholes-Merton model, for example, uses the concept of Brownian motion to price financial instruments – like European call options – over time.

Applying emerging quantum technology to financial problems—particularly those dealing with uncertainty and constrained optimization—should also prove hugely advantageous for first movers. Imagine being able to make calculations that reveal dynamic arbitrage possibilities that competitors are unable to see. Beyond that, greater compliance, employing behavioral data to enhance customer engagement, and faster reaction to market volatility are some of the specific benefits we expect quantum computing to deliver.

Quantum computing can also enable financial services organizations to re-engineer operational processes, such as:

– Front-office and back-office decisions on client management for “know your customer,” credit origination, and onboarding,

– Treasury management, trading and asset management,

– Business optimization, including risk management and compliance.

Quantum computing’s specific use cases for financial services can be classified into three main categories: targeting and prediction, trading optimization, and risk profiling.[4]

Commercial quantum applications for the financial industry

Of the dozens of quantum software start-ups around the globe, Multiverse Computing and Chicago Quantum have already developed specific quantum solutions for the financial sector and announced encouraging results in the area of portfolio optimization.

Multiverse Computing’s most mature product, an investment optimization tool, is capable of improving asset allocation and management, generating twice the ROI on average while the risk and volatility remain constant. Besides that, the company develops quantum-inspired solutions to predict financial crashes, determine anomalies in big unlabeled datasets, and identify tax fraud.

Chicago Quantum’s proprietary algorithm identifies efficient stock portfolios and, according to the company, “is currently beating the S & P 500 and the NASDAQ Composite 100 indices”.[3]

References:

- https://www.sciencedirect.com/science/article/pii/S2405428318300571

- https://www.mckinsey.com/industries/financial-services/our-insights/how-quantum-computing-could-change-financial-services

- https://www.supertrends.com/quantum-computing-in-banking-and-finance-threat-or-opportunity/

- https://www.ibm.com/thought-leadership/institute-business-value/report/exploring-quantum-financial

Cite this article:

Thanusri swetha J (2021), Quantum computing for finance, AnaTechMaz, pp.14