AI Surge Drives Data Centre Growth Amid Hyperscaler Risks

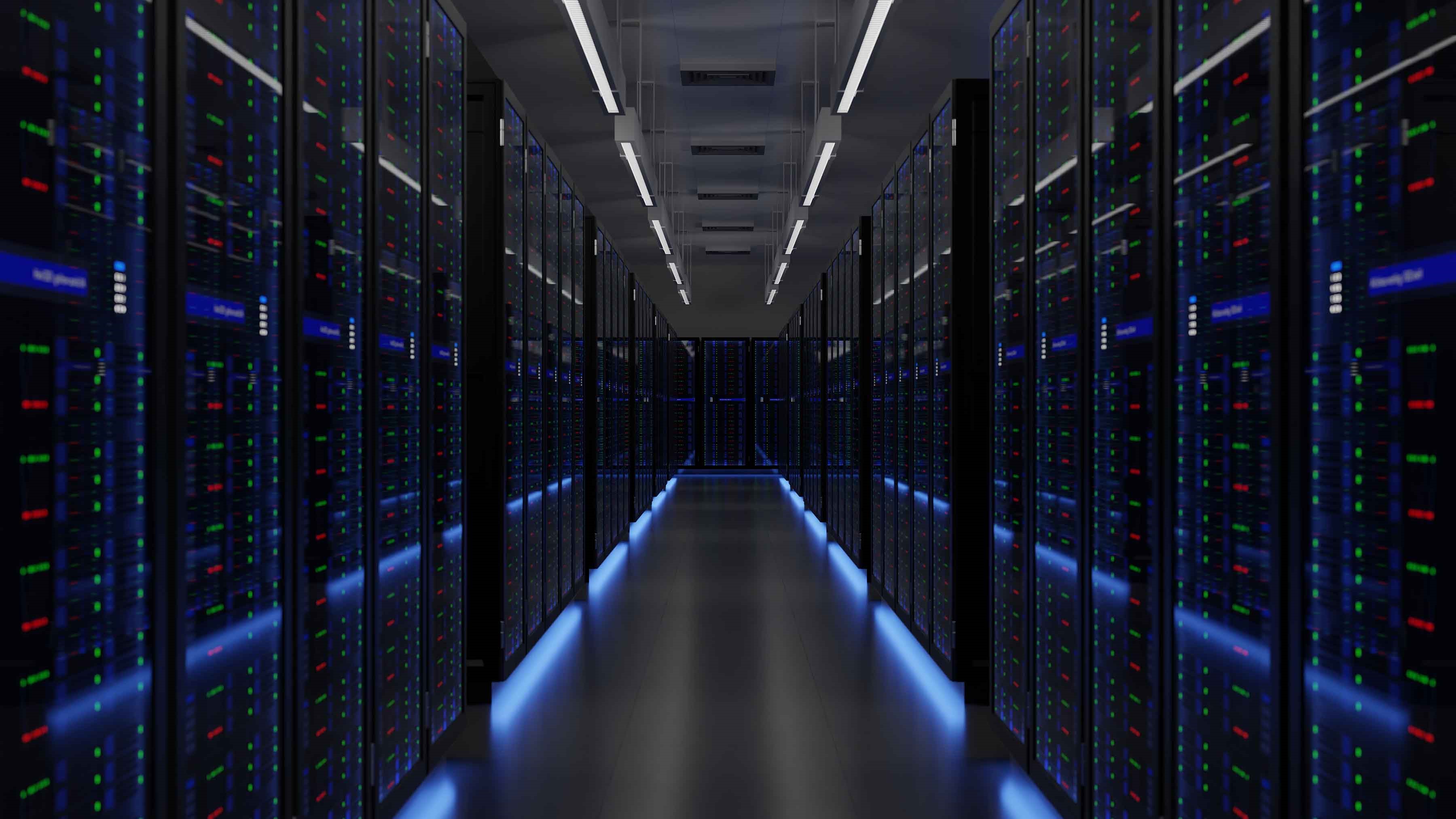

AI is revolutionising data centre infrastructure and driving unprecedented growth, particularly among hyperscalers. However, a new report from Moody’s Ratings highlights growing concerns over the financial, technical, and strategic pressures accompanying this expansion. As demand for data-intensive technologies like generative AI accelerates, hyperscale operators face significant risks related to power availability, site constraints, and escalating capital costs.

Balancing Growth with Sustainability

Moody’s Ratings projects data centre capacity to increase by 20% annually after 2028, a significant rise from the previous moderate 5% to 10% growth rates. Hyperscalers—major tech firms developing massive AI-focused server campuses—are driving this expansion. However, Moody’s highlights the growing challenge in accurately forecasting when this rapid growth might decelerate.

Figure 1. AI-Driven Growth in Hyperscale Data Centres

The report highlights that while hyperscale data centre growth will eventually plateau, pinpointing when this will happen is increasingly difficult due to AI data centres driving much of the expansion. These AI-focused facilities require specialised infrastructure to handle high electricity and cooling needs, often located in remote areas with reliable, low-cost power but facing challenges such as labour shortages and high transport costs. Additionally, legacy data centres struggle to manage the intense heat generated by AI workloads, making upgrades or replacements necessary. Rajesh Sennik, Head of Data Centre Advisory at KPMG UK, emphasized that the industry faces unprecedented demand for new infrastructure solutions to efficiently power, cool, and support next-generation computing, with AI fundamentally reshaping IT infrastructure architecture. Figure 1 shows AI-Driven Growth in Hyperscale Data Centres.

Massive Gigawatt Campuses and Strategic Challenges

Hyperscalers are developing AI data centre campuses on an unprecedented scale, consolidating gigawatts of computing power in single sites like the 5.6GW Wonder Valley in Alberta, Meta’s 2GW Louisiana facility, and OpenAI’s Stargate AI project, all expected to add significant capacity by 2029. However, much of this investment is speculative, with Moody’s warning that available infrastructure may outpace actual demand. As a result, capital reallocation and capacity adjustments are likely, since hyperscalers continuously recalibrate their leased and owned space based on evolving needs. This potential mismatch could impact utilisation, efficiency, and financial returns. Facilities designed for specific tenants may require costly upgrades if demands change or tenants depart. Given the soaring upfront costs—far exceeding those of previous tech waves—and rising rack power densities (now averaging 12kW and expected to hit 1MW–5MW), designing adaptable, power-efficient data centres is critical for sustaining long-term value.

Volatile Supply Chains and Increasing Costs

The rising costs of building and maintaining AI data centres stem not only from technical requirements but also from supply chain disruptions driven by trade policies and geopolitical tensions. US tariffs on imported steel and rare earth minerals are increasing material expenses, while tariffs on key electrical components risk causing further delays and bottlenecks. Moody’s warns that these pressures may lead developers to postpone projects or reconsider their capital strategies. The report also highlights how innovations like Chinese start-up DeepSeek’s AI chatbot, which uses fewer and less advanced chips than its US counterparts, can challenge the value of heavy capital investments.

Rapid AI advancements create a moving target for infrastructure needs, as facilities built today could become outdated within a few years if new models demand different chipsets, cooling systems, or energy solutions. For hyperscalers like Google, Amazon, and Microsoft, these risks don’t necessarily slow investment but add pressure on profit margins and operational flexibility. While financially strong companies can absorb short-term shocks, long-term cost forecasting grows increasingly complex. Moody’s notes that sudden shifts in tariff policies heighten uncertainty, making it harder for data centre developers to predict costs and timelines with confidence.

Navigating Innovation and Investment

As AI pushes technological boundaries, hyperscale data centre development faces a delicate balancing act. Building infrastructure ahead of demand involves financial and structural risks, yet underestimating AI’s growth could leave providers behind.

Hyperscalers must focus on creating infrastructure that is both adaptable and future-ready, considering rising rack densities, energy limitations, and geopolitical trade challenges. While AI is reshaping data centre architecture, Moody’s emphasizes that the critical question isn’t just how quickly the industry can build, but whether it’s building the right infrastructure at the right moment.

References:

- https://aimagazine.com/ai-strategy/the-ai-data-centre-potential-the-urgent-need-for-balance

Cite this article:

Janani R (2025), AI Surge Drives Data Centre Growth Amid Hyperscaler Risks, AnaTechMaz, pp.133