Unprecedented Pressure on Power Grids Due to Data Center Growth

Researchers: Data Center Power Demand Driven by AI and High-Performance Computing Needs.

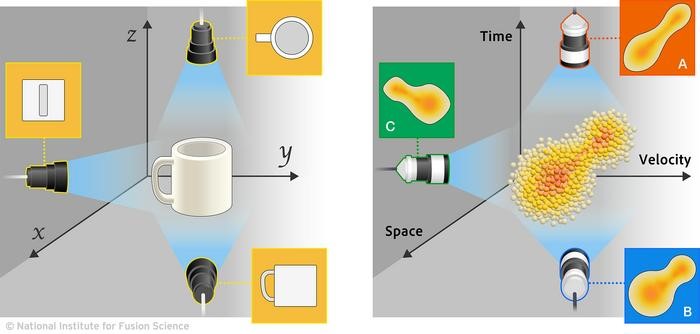

Figure 1. Unmatched Strain on Power Grids from Rapid Data Center Expansion.

U.S. Data Centers to Require 55 Gigawatts of New Power Capacity in the Next Five Years, Report Finds Figure 1 shows Unmatched Strain on Power Grids from Rapid Data Center Expansion.

A recent report by Bloom Energy highlights the pressing need for U.S. data centers to secure 55 gigawatts of new power capacity over the next five years. Based on a survey of 100 data center leaders, the report also reveals that by 2030, 30% of all data center sites will rely on onsite power.

McKinsey estimates that in 2024, U.S. data centers will need 25 gigawatts of power, with demand expected to exceed 80 gigawatts by 2030. This rapid growth is driven by digitalization, cloud migration, and the expansion of technologies like artificial intelligence. However, data centers require reliable power, and some regions are already facing power constraints.

In key hubs such as Northern Virginia, California, and Phoenix, the time required to establish new power connections is increasing. Furthermore, cities like Amsterdam, Dublin, and Singapore have imposed moratoriums on new data center builds due to insufficient power infrastructure. McKinsey notes that meeting the surge in electricity demand will be a significant challenge.

Goldman Sachs forecasts a 160% increase in data center power demand by 2030, compared to 2023 levels. However, power transmission infrastructure, which often takes 7 to 10 years to develop, is a major bottleneck. While power generation capacity can be expanded within 3 to 5 years, new high-voltage transmission lines have been steadily declining, with just 55 miles of new lines built in 2023 compared to 4,000 miles in 2012.

The Department of Energy (DOE) estimates that 115,000 miles of new transmission lines will be needed by 2040, doubling the current grid capacity. Companies are already planning for potential shortfalls in power supply to meet the growing demand.

Akamai Technologies, a distributed content platform, has increased its data center capacity by more than 50% over the past three years to meet growing demand. However, as Akamai’s Vice President of Global Data Center Strategy, Todd Lawrence, points out, the company remains dependent on its data center suppliers, and supply issues could arise in certain markets. To mitigate this, Akamai has developed three-, five-, and seven-year plans for each market and maintains regular communication with its providers to ensure continued access to critical data center resources.

Enterprises are also exploring broader geographic options and looking into renewable energy sources and fuel cells to power on-premise data centers. David Wilson, CEO of Energy Exemplar, explains that by integrating cost-effective renewable solutions like energy storage systems, businesses can balance reliability and sustainability. He also highlights renewable alternatives like biomass, green hydrogen, and even small modular reactors that present fewer variability challenges compared to wind and solar.

However, renewables face the same transmission infrastructure challenges as traditional energy sources. Aman Joshi, Chief Commercial Officer at Bloom Energy, notes that this is why nearly one-third of data centers are turning to on-site generation solutions.

Supporting this trend, Frost & Sullivan reports that the growth of stationary fuel cell deployments, which are used by data centers and industrial plants, is accelerating. From 345 megawatts in new installations in 2023, the number is expected to increase to 1,420 megawatts annually by 2035. Major players in this market include Bloom Energy, Doosan-HyAxiom, FuelCell Energy, and Panasonic, with Bloom Energy leading the charge.

Jonathan Robinson, Global Power and Energy Research Director at Frost & Sullivan, emphasizes the strong growth potential in the decentralized energy solutions market, with manufacturers focused on strengthening supply chain resilience and reducing costs. Bloom Energy’s Joshi adds that his company is expanding production and is not facing the same supply chain constraints as other technologies, allowing it to scale confidently.

Source: NETWORKWORLD

Cite this article:

Priyadharshini S (2025), Unprecedented Pressure on Power Grids Due to Data Center Growth, AnaTechMaz, pp.104