ATM Interchange Fee Increase Highlights Micro-ATM’s and Financial Inclusion

The National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI) have announced an increase in ATM interchange fees for cash withdrawals from ₹17 to ₹19, effective May 1, 2025. However, micro-ATM transaction fees remain unchanged at 0.5% of the transaction amount or ₹15, whichever is lower. This has raised concerns about the long-term sustainability of the business correspondent (BC) network, which primarily relies on micro-ATMs for financial services.

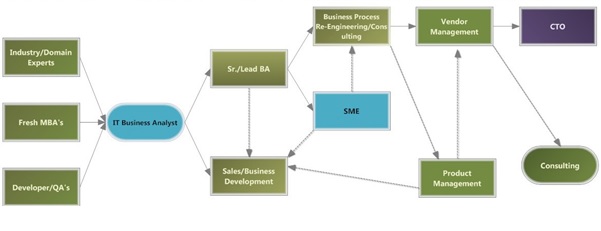

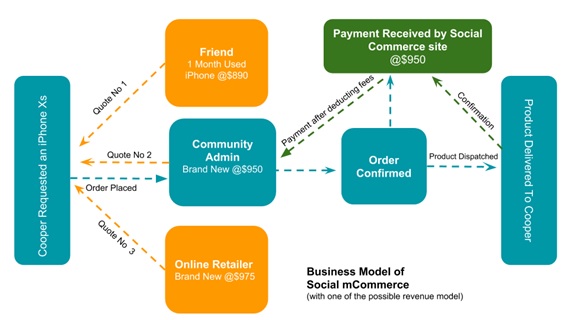

Figure 1. Impact of ATM Fee Hike on Micro-ATMs and Financial Inclusion.

Understanding the ATM Interchange Fee Hike

The Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI) recently announced an increase in ATM interchange fees for cash withdrawals from ₹17 to ₹19, effective May 1, 2025. This fee applies when a customer uses an ATM of a bank other than their own. The increase aims to support banks in maintaining and expanding ATM networks, but it also raises concerns about accessibility and affordability for consumers. Figure 1 shows Impact of ATM Fee Hike on Micro-ATMs and Financial Inclusion.

Micro-ATMs – A Low-Cost Alternative

While traditional ATMs see a fee hike, micro-ATMs remain at the same pricing structure—charging 0.5% of the transaction amount or ₹15, whichever is lower. Micro-ATMs are handheld devices operated by business correspondents (BCs), allowing banking transactions in rural and underserved areas. This stability in pricing makes them an attractive alternative for cash withdrawals and other banking services.

Impact on Business Correspondent (BC) Networks

Business correspondents, who rely on micro-ATMs to provide banking services in remote areas, are facing concerns over the unchanged pricing. With rising operational costs and no increase in service charges, BCs may struggle with profitability. This raises questions about the long-term sustainability of the BC network and whether the government or regulators will intervene to support them.

Financial Inclusion – A Double-Edged Sword?

Micro-ATMs play a crucial role in financial inclusion by offering banking access to people without easy access to traditional ATMs. However, if BC networks become financially unsustainable, it could limit the availability of micro-ATM services, negatively impacting rural banking. On the other hand, the fee stability may help prevent costlier cash withdrawals for economically weaker sections who depend on micro-ATMs.

The Future of Banking Accessibility

As India moves towards a more digitized financial ecosystem, the role of ATMs and micro-ATMs is evolving. The ATM fee hike could push more people toward digital transactions, but cash dependence remains significant, especially in rural areas. Policymakers may need to revisit the micro-ATM fee structure to ensure BC networks remain viable while continuing to promote financial inclusion. The future of banking accessibility will depend on striking a balance between cost, convenience, and sustainability.

The recent decision by the Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI) to increase ATM interchange fees from ₹17 to ₹19 for cash withdrawals has sparked discussions on the future of banking accessibility, especially for underserved communities. While this fee hike may support banks in maintaining ATM networks, it also places a spotlight on micro-ATMs, which remain a cost-effective alternative for financial transactions.

Why Micro-ATM Fees Remain Unchanged

Despite the ATM fee hike, micro-ATM transaction fees remain unchanged—capped at 0.5% of the transaction amount or ₹15, whichever is lower. This pricing structure ensures that cash withdrawals through micro-ATMs remain affordable, making them a preferred choice for customers in rural and semi-urban areas. However, the lack of a fee revision raises concerns about the financial sustainability of business correspondents, who rely on these transactions for income.

The Road Ahead for Banking Accessibility

The fee hike on traditional ATMs may push more people toward digital banking solutions, reducing cash dependence. However, given that cash transactions remain dominant in rural India, micro-ATMs will continue to play a vital role. Policymakers might need to reassess the micro-ATM pricing structure to ensure that BC networks remain financially viable while maintaining accessibility for underserved communities.

Reference:

- https://www.business-standard.com/industry/banking/hike-in-atm-interchange-puts-spotlight-on-micro-atms-financial-inclusion-125032800701_1.html

Cite this article:

Priyadharshini S (2025),"ATM Interchange Fee Increase Highlights Micro-ATM’s and Financial Inclusion",AnaTechmaz, pp. 76