Essential Methods of Predictive Analytics

The term predictive analytics refers to the use of statistics and modelling techniques to make predictions about future outcomes and performance. Predictive analytics looks at current and historical data patterns to determine if those patterns are likely to emerge again. This allows businesses and investors to adjust where they use their resources to take advantage of possible future events. Predictive analysis [1] can also be used to improve operational efficiencies and reduce risk

- Predictive analytics uses statistics and modeling techniques to determine future performance.

- Industries and disciplines, such as insurance and marketing, use predictive techniques to make important decisions.

- Predictive models help make weather forecasts, develop video games, translate voice-to-text messages, customer service decisions, and develop investment portfolios.

- People often confuse predictive analytics with machine learning even though the two are different disciplines.

- Types of predictive models include decision trees, regression, and neural networks.

Uses of Predictive Analytics

Predictive analytics is a decision-making tool in a variety of industries.

Forecasting

Forecasting is essential in manufacturing because it ensures the optimal utilization of resources in a supply chain. Critical spokes of the supply chain wheel, whether it is inventory management or the shop floor, require accurate forecasts for functioning.

Predictive modeling is often used to clean and optimize the quality of data used for such forecasts. Modeling ensures that more data can be ingested by the system, including from customer-facing operations, to ensure a more accurate forecast.

Credit

Credit scoring makes extensive use of predictive analytics. When a consumer or business applies for credit, data on the applicant's credit history and the credit record of borrowers with similar characteristics are used [2] to predict the risk that the applicant might fail to perform on any credit extended.

Underwriting

Data and predictive analytics play an important role in underwriting. Insurance companies examine policy applicants to determine the likelihood of having to pay out for a future claim based on the current risk pool of similar policyholders, as well as past events that have resulted in payouts. Predictive models that consider characteristics in comparison to data about past policyholders and claims are routinely used by actuaries.

Marketing

Individuals who work in this field look at how consumers have reacted to the overall economy when planning on a new campaign. They can use these shifts in demographics to determine if the current mix of products will entice consumers to make a purchase.

Active traders, meanwhile, look at a variety of metrics based on past events when deciding whether to buy or sell a security. Moving averages, bands, and breakpoints are based on historical data and are used to forecast future price movements.

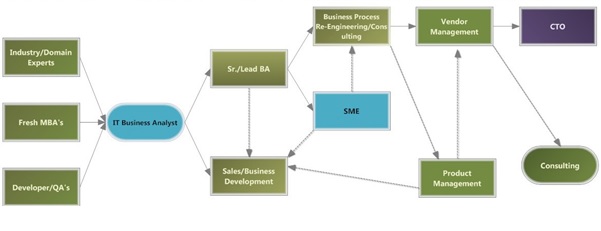

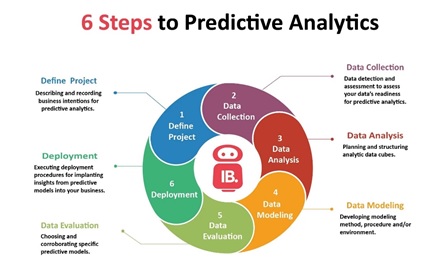

Figure 1. Predictive Analytics

These models determine relationships, patterns, and structures in data that can be used to draw conclusions about how changes in the underlying processes that generate the data will change the results [3]. Predictive models build on these descriptive models and look at past data to determine the likelihood of certain future outcomes, given current conditions or a set of expected future conditions.

References:

- https://www.northeastern.edu/graduate/blog/predictive-analytics

- https://www.ibm.com/analytics/predictive-analytics

- https://www.mathworks.com/discovery/predictive-analytics.html

Cite this article:

S. Nandhinidwaraka (2021) Essential Methods of Predictive Analytics, AnaTechMaz, pp. 4