Transform ESG with technology

For corporate leaders, their firm’s performance on environmental, social and governance (ESG) parameters has become increasingly critical. It is not just a reporting requirement – it is also important because big investors and customers are scrutinising the record and initiatives taken by the management in these areas. According to EY’s most recent CEO survey, almost 40% of global executives state that they would like to increase their oversight of ESG factors in assessing enterprise-wise risks. [1]

Figure 1. Transform ESG with technology

Figure 1 shows in most companies, ESG discussions typically focus on issues such as environmental protection, biodiversity, health and safety, business ethics, and diversity in boardrooms. Technology-related risks and opportunities are not sufficiently taken into account. But three areas that business leaders need to focus on now are Green Software, AI Bias, and Trusted Data. They will have a huge impact on all three – E, S and G – components of the organization in the future. [2]

Green software

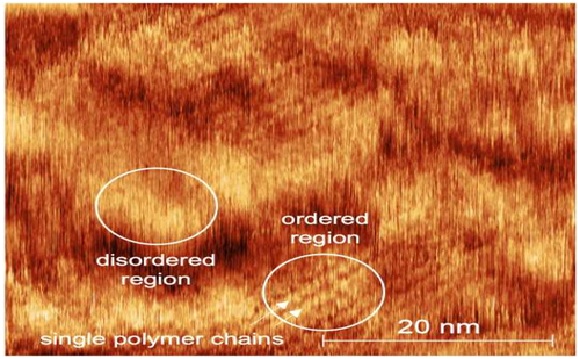

It has come to the fore due to the exponential growth in cloud adoption by global enterprises driven by the pandemic. Data centers already account for more than 1% of the total global electricity consumption every year. It is expected to skyrocket, accounting for 8% of the world’s total electricity demand over the next 10 years.

Data centres not only consume a lot of electricity, they also require a lot of water to keep cool. The environmental footprint of data centres is becoming a big area of concern around the world. Optimising hardware and using solar or other renewable sources for electricity helps in reducing the carbon footprint to an extent. But an area that can also help immensely is green software – where the software’s algorithm ensures maximum energy efficiency. This is critical because the electricity consumed in data centres is directly dependant on how efficiently software applications handle hardware resources. [3]

Trusted Data

Currently, investors rely on two primary information sources for making funding decisions. The first is a company's self-reported quantitative and qualitative data around ESG impact. The second is peer benchmarking of a company's ESG performance, for which third-party ESG ratings are leveraged. Unfortunately, the plethora of rating methodologies often impedes objective decision-making. This issue can be addressed by triangulating the above data points by leverage. [1]

References:

- https://economictimes.indiatimes.com/small-biz/sme-sector/how-to-transform-esg-with-technology/articleshow/92014803.cms

- https://fiorreports.com/esg-how-to-transform-esg-with-technology/

- https://paidforarticles.com/how-to-transform-esg-with-technology-1-635564

Cite this article:

Thanusri swetha J (2022), Transform ESG with technology, AnaTechMaz, pp.149